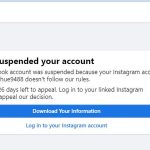

Why I no longer have Facebook

August 24, 2024

A Painting Invites an Air of Peace and Calm

November 18, 2024Office Art. Why is this a win-win scenario?

An office with walls that speak?

Most certainly, yes!

Art is undoubtedly an essential part of home decor and interior design, an element that brings character and colour in a residential setting.

But what about an office? Does art belong in a workplace or commercial scene? Most definitely, yes!

Firstly, the fact that art encourages dialogue is powerful in a work setting. A piece of art, creates an opportunity for open exchange, the freedom to a different opinion. Nobody is right. Nobody is wrong.

A painting that suits an office space does not scream for attention. Rather, it knows when to be a silent observer and when to initiate conversation.

Art softens spaces. It nourishes creativity and reminds us that there are usually multiple ways to approach a problem, or an issue.

Art brightens up your day. A happy employee is a productive employee. Right?

These are just a few reasons why I strongly believe that art belongs not only in our homes, but in our lives. Wherever we are.

Investing in an original artwork for a place of work, creates a win-win scenario for the company and the artist. Buying from an Australian artist - preferably directly to avoid hefty gallery fees, you are improving the atmosphere in your workplace and supporting a local artist.

PLUS there is the tax benefit. Did you know that artworks used or displayed in a place of work are considered a depreciated asset, and as such are 100% tax-deductible (up to $20,000)?

I am no tax advisor, and might get my words mixed up here, but talk to your accountant.

And after that, talk to me.